MVNO Network Monitoring

- Susie S

- Jul 17, 2025

- 7 min read

Updated: Jul 21, 2025

Mobile Virtual Network Operators (MVNOs) have quietly become a multibillion‑dollar force in telecoms. Analysts put the global MVNO market at roughly US $ 98 billion in 2025, on track to top US $ 170 billion by 2032 Fortune Business Insights, while subscription counts are expanding faster than the wider mobile market, at 3.6 % CAGR through 2029 Omdia. In other words, more consumers, enterprises and connected “things” are choosing a brand that doesn’t even own a radio tower.

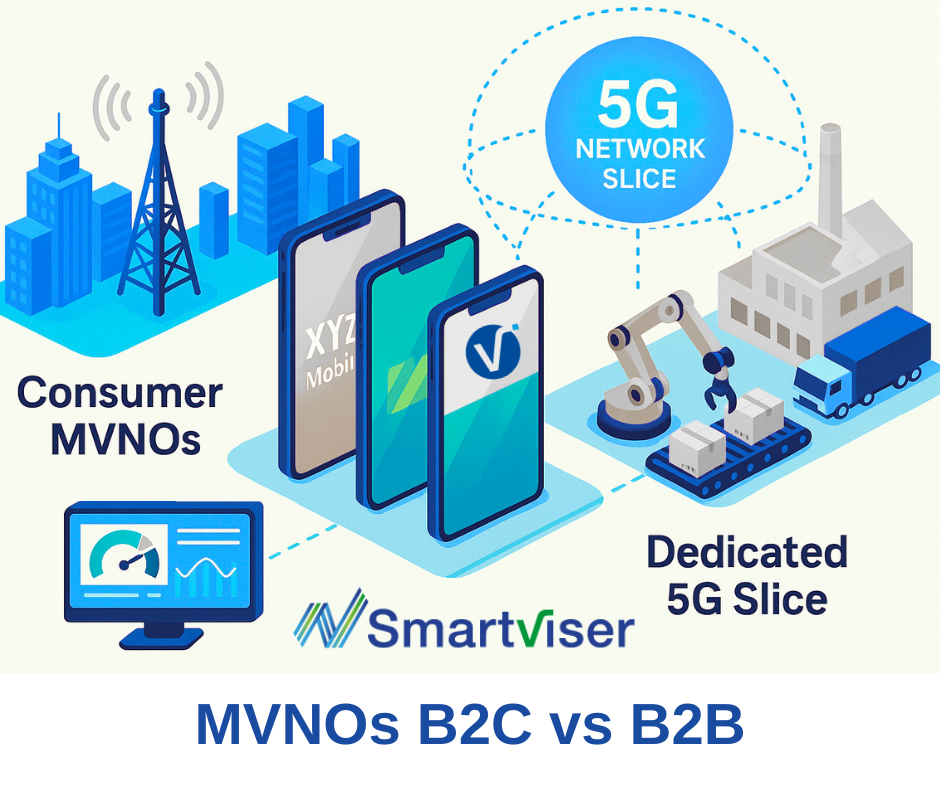

Yet the commercial freedom MVNOs enjoy—lighter assets, faster launches, razor‑sharp niches—comes with a hidden catch: they must guarantee service quality over infrastructure they don’t control. That tension only intensifies as the industry splits into two distinct camps:

B2C MVNOs chasing price‑sensitive or lifestyle segments, where a single dropped call can trigger social‑media churn.

B2B/enterprise MVNOs delivering 5G network slices for factories, hospitals and fleets, where penalties kick in the moment an SLA is missed.

In this article we will —

Define what an MVNO is and how it differs from its host MNO.

Map the main MVNO flavours, from discount consumer brands to slice‑enabled industrial players.

Unpack the operational challenges—margin squeeze, RAN dependency, tight enterprise SLAs—and the KPIs that matter.

Show how SmartViser’s test‑automation and real‑device monitoring platform closes the assurance gap, giving MVNOs live QoS & QoE evidence they can take to the boardroom—or the customer’s service review.

Whether you run a consumer sub‑brand or a mission‑critical IoT network, robust testing and continuous monitoring aren’t optional extras; they are the foundations of subscriber trust and contract profitability.

What exactly is an MVNO?

A mobile virtual network operator (MVNO) is a telecom brand that buys wholesale radio‑access capacity from a licensed mobile‑network operator (MNO) and resells it under its own brand. An MVNO typically owns the commercial layers—SIMs/eSIMs, branding, pricing, customer care, billing and sometimes its own core network elements—but does not own spectrum or base‑station (RAN) assets, which remain under the MNO’s control. In contrast, an MNO finances and operates the radio spectrum, towers, back‑haul and national licences. Some MVNOs integrate more deeply (so‑called full MVNOs with their own HLR/HSS, PGW, etc.), whereas “light” or “reseller” MVNOs focus mainly on sales and marketing Onomondo.

How MVNOs differ from MNOs at a glance

Area | MNO | MVNO |

Spectrum & RAN | Owns/licensed | Rents wholesale |

CapEx intensity | Very high | Low/asset‑light |

Network control | Full QoS prioritisation | Limited; subject to host MNO prioritisation |

Time‑to‑market | Slower (infrastructure cycles) | Faster, brand‑driven |

Typical differentiation | Coverage, bundling (handsets, fixed lines) | Pricing, niche segments, value‑added services |

Key challenges MVNOs face today

Quality‑of‑service dependency – Traffic is usually deprioritised during cell congestion, leading to higher latency, jitter or lower speeds compared with the host MNO.

Next‑gen technology access (5G SA, network slicing, VoLTE/VoNR) – MVNOs rely on their host to make features available and must then ensure handset compatibility and back‑office upgrades.

Margin pressure from wholesale rates & price wars – Wholesale terms are often volume‑based; intense SIM‑only competition erodes ARPU.

High churn & Customer Acquisition Cost (CAC) – Budget‑conscious users are quick to switch; marketing spend can outstrip lifetime value if not managed carefully.

Limited brand stickiness – When the core offer is “same network, lower price”, differentiation must come from service experience, ecosystem perks or laser‑focused niches.

Regulatory & data‑privacy compliance – KYC/AML rules, eSIM remote provisioning, emergency‑services location accuracy, GDPR, etc.

Operational visibility – Without direct access to RAN counters, MVNOs must invest in active/drive‑testing or API‑based monitoring to see what customers really experience.

KPIs MVNOs should monitor continuously

Technical / QoS KPIs

(Test Automation and smartphone devices as probes & SLA management)

Access/Attach success rate – SIM registration & authentication failures

Voice – Call‑setup time (CST), VoLTE fallback rate

Data – DL/UL throughput http/ftp/bi-directional, latency (RTT), jitter, packet‑loss %

Messaging – SMS/MMS delivery time & success rate

5G slice availability / hand‑over success

Consumer‑ vs business‑focused MVNOs

Dimension | B2C MVNOs | B2B / Enterprise‑first MVNOs |

Typical positioning | Low‑cost SIM‑only, lifestyle/brand extensions ( e.g. supermarket, youth, ethnic calling ) | Managed mobility, IoT connectivity, private/campus networks, global eSIM hubs |

Buyer | Individual subscribers‑at‑scale | CIO/CTO, operations or OT teams |

Value lever | Price simplicity, community perks, flexible bundles | SLA‑backed connectivity, integration with IT/OT, analytics & security |

Wholesale deal | Usually “best‑effort” bit‑pipe with retail margin | Often bespoke: dedicated APNs, static IP, QoS class identifiers (QCIs) or a full 5G network slice |

Capabilities to own | Digital CX, referral engine, churn analytics | Service orchestration, SIM lifecycle, edge/cloud integration, multi‑IMSI steering |

Regulatory load | Consumer protection, number portability | In addition: ISO 27001, sector‑specific (health, utilities), data‑residency |

B2C archetypes

Discount/price‑fighter – e.g. SMARTY, Visible.

Brand‑extension – e.g. Tesco Mobile, Superdrug Mobile.

Community/lifestyle – youth (giffgaff), international (Lycamobile).

Digital nomad/eSIM‑only – Airalo, Holafly.

B2B archetypes

Corporate mobility MVNO – pooled data and voice with global roaming, device‑fleet portals.

IoT/M2M specialists – connectivity plus API/SaaS for logistics, automotive (KORE, Cubic Telecom).

Private‑/campus‑5G enablers – carve out a wholesale 5G network slice or lease local spectrum to run an on‑prem 5G core for factories, ports or hospitals

MVNO‑as‑a‑Service aggregators – white‑label platforms letting brands spin up their own offers.

Why network slicing is a game‑changer for B2B MVNOs

Network slicing (5G SA) = a virtual end‑to‑end network instance with its own QoS, security and policy, delivered over the shared RAN, transport and core.

What an enterprise MVNO can do with a slice

Use case | Slice attribute | Example vertical |

Ultra‑reliable low‑latency comms (URLLC) | ≤10 ms RTT, 99.999 % availability | Robotics on an automotive line; remote surgery rooms |

Massive IoT (mMTC) | Battery‑efficient signalling, high device density | Smart‑meter fleets, agriculture sensors |

High‑throughput FWA | Guaranteed 200 Mbps+ downlink | Retail branch connectivity, pop‑up venues |

Mission‑critical voice/video | Priority bearer, local breakout | Public safety, energy utilities |

With GSMA Open Gateway and 3GPP NEF APIs, a full MVNO can programmatically request, expand or tear down slices per customer or per site, bundling them with edge‑compute and security services CSG

Commercial models emerging

Slice‑as‑a‑Service – monthly fee per site/device group for a managed slice.

Private‑network extension – single SIM roaming seamlessly between a campus slice and the public macro network (Transatel P‑LTE/5G extension) Transatel.

Outcome‑based SLA – e.g. “< 50 ms motion‑control latency, 99.95 % uptime”, with penalties baked into the wholesale agreement.

Additional challenges specific to B2B MVNOs

Challenge | Mitigation |

Multi‑slice orchestration & OSS/BSS readiness | Adopt cloud‑native core and policy control that can tag traffic per slice; upgrade billing to rate per SLA tier. |

Device & modem compatibility | Work with OEMs for SA‑capable chipsets and enterprise firmware supporting slice selection and URSP rules (Android Open Source Project). |

Security & isolation | Offer options for on‑prem UPF breakout, IPsec tunnels into enterprise WAN, zero‑trust SIM authentication. |

Complex contracting | Enterprise‑grade support (24/7 NOC), liability cover, and procurement frameworks (ITIL, ISO, NDAA where needed). |

Why continuous, real‑device monitoring is critical for MVNO SLAs

Enterprise contracts usually carry tight latency, throughput and availability guarantees that far exceed consumer “best‑effort” levels. Because an MVNO has no native RAN counters and may be running several dedicated 5G slices at once, the only reliable way to prove compliance—or to catch a breach before it hurts production—is to measure performance from the same device types and SIM profiles the customer actually uses.

SmartViser’s viSer platform shows how this is done: it turns ordinary Android or iOS handsets into 24 × 7 autonomous probes that execute user actions like voice, data, video and application workflows on the live slice, streaming granular QoS metrics (throughput, latency, hand‑over success,) and QoE metrics (POLQA MOS, page‑load time, video buffering, battery drain) to a cloud dashboard.

Because every data point comes from a real device under real radio conditions, the MVNO can present indisputable evidence during quarterly service reviews, trigger automated trouble tickets the moment a KPI drifts, and even feed predictive models that warn of SLA breaches before users notice.

Conclusion

Across today’s rapidly evolving MVNO landscape—from cost‑focused consumer brands to enterprise providers leveraging dedicated 5G network slices—successful operators have three critical imperatives:

Clearly define and differentiate the value proposition. Whether addressing budget‑sensitive retail segments or delivering high‑availability, low‑latency connectivity for industrial sites, each MVNO must translate wholesale capacity into a distinctive customer experience.

Monitor the metrics that matter. Technical key performance indicators such as call‑setup success, data throughput, latency, messaging delivery and slice availability form the foundation of service assurance. When correlated with commercial measures—churn, Net Promoter Score and contractual SLA compliance—these metrics provide a comprehensive view of network health and business performance.

Provide continuous, evidence‑based assurance. Measurements taken on real smartphones and IoT endpoints, under live network conditions, remain the most reliable proof of Quality of Service (QoS) and Quality of Experience (QoE), particularly where financial penalties are tied to enterprise SLAs.

SmartViser: Comprehensive, Automated Assurance

SmartViser’s integrated platform addresses these imperatives through a fully automated, device‑centric monitoring solution:

SmartViser Capability | Benefit to the MVNO |

viSer autonomous device probes | Converts standard smartphones and industry‑specific devices into 24/7 test agents—eliminating the cost and complexity of traditional testing. |

Voice, data, messaging, and slice workflows | Recreates real user journeys, capturing detailed QoS and QoE indicators. |

Multi‑layer interactive dashboard | Consolidates network and SLA data into an intuitive interface, |

SmartViser thus equips MVNOs with a single, end‑to‑end assurance framework—transforming raw network data into actionable intelligence while reducing operational overhead. By adopting this platform, MVNOs can demonstrate service excellence, uphold stringent SLAs and maintain the customer confidence that underpins sustainable growth.

Susie Siouti is the Chief Commercial Officer for SmartViser helping organisations in the Telecommunications industry offer superior end-user quality of experience and service with the introduction of innovative test automation products. Susie has 20 years of experience in the Telecoms industry and in that time has led teams across the world mainly in Testing and Compliance. Holding an MBA from Henley Business School brings a diverse set of skills and expertise, including business acumen, strategic thinking, financial management, sales and marketing expertise, leadership, and innovation.

Susie joined SmartViser in 2016, is part of the internal steering committee, responsible for developing and implementing the company's commercial strategy and encouraging a customer-centric culture. The main mission is to help organizations to create value by offering better quality products and services by improving operational efficiency and innovation.

Comments